Author Archive

Full Time Mom

Such an honor to be a guest on Full Time Mom Radio! Thank you, Francielle Daly, for the opportunity!

Here’s the replay! “3 Steps for Moms So You Can Raise Wealthy Kids”

1 pm Eastern, Noon Central: “Full Time Mom!” host Francielle Daly

Join Francielle Daly, airing from Chicago, every “Mommy Monday” for tips, tricks, strategies, and discussion about the joys and challenges of being a Full Time Mom!

WWTO

KWIC Teen Blog

My first introduction to Kids Wealth International Club was at the Kids Matter Job fair in March 2012. I was 15 and I had decided that it was time to try and dip my toe into the real world. A few minutes into walking around with no real interest in anything, a big purple banner caught my eye. It said, “Kids Wealth International Club”. I thought to myself, “I like kids. I like being rich. Clubs are fun too, I guess. And… Traveling?” So I went to go see what it was about. There, I got the basic overview: Kids Wealth International Club is a company that teaches children and young adults how to handle and grow their money safely and effectively. It sounded like a great idea, so I put my name on the contact list and walked away. As I rotated through the different booths, I found that nothing roused my curiosity as much as Kids Wealth International Club, so I went back to the booth. That was when I got to meet Melanie Jane Nicolas. My first impression of her was that she knew what she was doing with her life. This was a woman who had figured out what she loved doing and had found a way to do it. As I continued talking to her, my first impression solidified. I went home that day not really sure about getting a job, and I soon forgot about it.

A couple weeks later, I got an email from Kids Wealth International Club for a group job interview. I got really excited about it but I was doubtful that I had much of a chance. When I got there, I met some of the other prospective employees and I was downright intimidated. Here was a group of high schoolers much older than my freshman self. When Melanie started talking about what they did as a company, I was fascinated and put aside my misgivings. By the end of the interview, I knew that I really wanted to be a part of this organization that prepared kids and teens for an inevitable future filled with bills, taxes, money and mortgages: things that are never covered in school. That day, Melanie left us with the option of coming in as a volunteer for one of her Mini Camps.

The Mini Camp was on a Tuesday evening and had a combination of parents and kids. I was the only volunteer who had come, and I was so glad that I did; I did not know most of the things that the elementary school kids were learning. I got to reward them for their answers and join in on some of their games. While it was a great experience working with the kids, more importantly, it was an eye opener as I realized that I had a gaping hole in my education. This hole was probably the worst hole I could have because it wasn’t just some complex calculus I would probably never do; it was a hole in how to survive in the real world. I am not the only one with this hole either; most of my high school friends do not know how to manage their money or pay bills or invest.

While I did not know this then, the Mini Camp was my gateway to a permanent position with Kids Wealth International Club. Melanie told me later that my willingness to show up and take initiative in my life was what had made the decision to hire me. This made me aware of the power of our choices and how easy it is to miss out on opportunities if we do not follow through and pursue our interests.

Today, I have been working with Kids Wealth International Club for a little over a year. I help with the camps, teaching and learning essential life lessons. Already, at 16 years old, I have learned more than my numerous mistakes would have taught me if I had stumbled along after college. Hopefully it prevents my mistakes as well.

~Devashri

WOW Your Kids!

WOW Your Kids!

I am currently in the Philippines with my kids and we have enjoyed our vacation here. Because the cost of living is so low, my mom has hired 2 nannies to take care of my kids. I allow them to do the laundry, cook and help them get ready in the morning, but my kids are disciplined to not be spoon-fed. I cringe when I see kids here 7 years old and older being spoon fed.

Before my children came to the Philippines, they had saved all their money from their living, play and donation jars. I kid you not, but I have not spent a single cent on anything the kids have bought. My daughter Jardel bought all her clothes and Dylan has paid for his massages (yes, he loves them like Mommy and they are only $7 per hour here). We have had so much fun as a family while being financially responsible. Not only that, but my kids still give their tithing in church and have given to their sister in Christ that we have sponsored for the past 3 years here in the Philippines. Making money real to my kids is THE best way to teach them money management.

WOW your kids! One of the things I have been intentional about throughout our vacation are the experiences I want my kids to have. Some of their firsts are having a fish spa, where they dipped their legs into a tank filled with hundreds of fish and the fish eat the dead skin off of their legs, snorkeling in the ocean and feeding all types of fish while doing so, riding a horse by a volcano, and eating at the bottom of the waterfalls…everything is educational. They have an even more true appreciation when we passed by the slums and they saw all the little kids begging for money and food. And, they are proud to understand that all that they have has been rightfully earned. On the other hand, my kids also have questions like, “If people are so poor, why do they spend $4 for a coffee at Starbuck’s?” All over the world, financial literacy is so needed in a world screaming of entitlement…even here in the Philippines, where the average income is $3,000 per year. We have experienced riding in an air conditioned car with a driver and a tricycle packed like sardines…everything with purpose. My kids learn best through experience, and the experiences they’ve had here are definitely some of the greatest learnings they will take on throughout their life.

We’ll be back in a week, and people have asked me if I miss home. I say, “Home is where my heart is, and my heart is with my kids.”

37

The Big 3-7!

The big 3-7!!! Yes, Monday I turned 37 years old. Isn’t it interesting that my birthday is during Youth Financial Literacy Month? Serendipitous? Here are me and my family celebrating my birthday! After 3 ducks later, duck fried rice, duck noodles and duck soup…we were finally full. Yes, we went to a duck restaurant Sun Wah:) Then we ended our day at A Taste of Heaven for my favorite cake, Jeannine’s cake…Yummm!

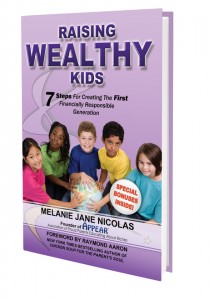

This year has been filled with many wins and challenges. Finding a home for our summer camps at Safety Town. Having a huge success for our Ribbon Cutting with Mayor George Pradel. I learned how to play golf in preparation to play golf at a Trump golf course. I flew on Trump’s helicopter. Speaking on stage in front of 650 entrepreneurs playing full out as kids. The most recent, becoming Best-Selling Author for my book Raising Wealthy Kids: 7 Steps for Creating the First Financially Responsible Generation. My bigger accomplishment is the person I’ve become since my Spiritual Retreat. As I reflect on all the great work I have accomplished this past year, I have realized that my best work is right here in my home…my children. Their accomplishments are a reflection of my intentional and passionate parenting as a single mom. My daughter got her book published, My wInner Self. I don’t think she knows the extent of this accomplishment and saying that she is an author since age 7. She also won an iPad Mini and is putting herself out there in becoming an entrepreneur earning $1,000 from her book sales. All my kids learned how to play hockey and ice skate this year…my 4 year old Dean learned both roller and ice hockey. My kids are my passion and the reason I do what I do.

As parents, we all want the best for our children. All of us! And so we work so hard to give them just that…all the education and life values they need to go out into the world so they have the best chance to be all that they can be. To live their fullest potential and step into their greatness. In order for them to do this, I need to be modeling these beliefs and live the values I instill in them. But I understand, even if we want the best for our children, sometimes we don’t have the time (this is a big one for me that I overcame this year), or the knowledge base, or we simply don’t know where to start. And that’s why I founded APPEAR – The Association of Proud Parents Educating About Riches. We will give you and your kids a start.

As I move and look forward to my next year of my life, again I reflect on my 5 Pillars of Wealth. I need to have all of this to be living on purpose and to be my truest self.

My 5 Pillars of Wealth

- Spiritual

- Physical

- Emotional

- Social

- Financial

Without my health, at the end of the day, all I do will not matter. Without my awesome relationships with my children, all that I do will not matter. Without my connection with God, all I do will not matter. Ask yourself, which of these Pillars is not balanced in my life?

To You and Your Wealthy Kids,

Melanie Jane Nicolas

“Live With Passion. Love Unconditionally. Make a Difference.”

P.S. If you missed my book launch last month you can go HERE to buy my new book, Raising Wealthy Kids: 7 Steps for Creating the First Financially Responsible Generation.

P.P.S. Please join our first APPEAR event, Parent Discovery Day on April 30 (more details to come), where we will give you a start on how to raise wealthy children and give them a sense of responsibility, leadership, and how wealth is really created.

My 9 year old and her evil plan

This weekend was a wonderful experience for my daughter Jardel and me. We attended the Millionaire Business Bootcamp here in Chicago. It was Jardel’s first entrepreneurial event where she learned with mommy for 3 full days, and she was so excited! Not only did she get to sell and autograph her books, be interviewed on stage, and take a picture with my mentor Raymond Aaron, James Lafferty (CEO of Proctor and Gamble and Coca-Cola Nigeria), and Ernesto Verdugo (Internet Marketing Guru), she also entered into a contest.

So my coach was giving away 2 iPad Minis. On the first day, Jardel told me she really wanted to win the iPad Mini, and asked what she had to do. The contest consisted of creating a video, testimonial, or anything creative about the Millionaire Business Bootcamp. Now, Jardel is the type of girl who doesn’t particularly like to be on camera nor does she like to compete in “fear” of not winning. I have been instilling in her that as long as she does her best, she IS a winner. This contest was different though. It’s as if she kept her eye and her mind on the goal, and there were no obstacles. She was eager to win the iPad Mini. Interestingly enough, we were learning about goals. My coach Raymond says, “Obstacles are the ugly things you get to see if you take your eyes off the goal.” These ugly things are not real. They are all in our minds. So Jardel’s fears were not even obstacles anymore because she didn’t take her eyes off the goal…the iPad Mini. She really wanted to win that she asked, “How can I win?” and “What kind of video can I create that will win?”

Watch her video below…

Did she win? Of course! Here she is so happy with he new iPad Mini. She earned it!

In our camps, we teach kids how to set goals and encourage their minds to never give up. 90% of winning in life is all in the mindset. Parents also need to watch what they say, do and experience around their kids because, let’s face it, we are their role models. Our actions need to be intentionally congruent with our values. This weekend was definitely an experience Jardel will always remember!

To You and Your Wealthy Kids,

Melanie Jane

P.S. For a fun experience with your kids so that you can learn about wealth together, come to our next KWIC Money Smart Mini-Camp on March 25-27 at Naperville Safety Town. Click HERE for more details

From the Desk of Melanie Jane Nicolas – February 2013

From the Desk of Melanie Jane Nicolas – February 2013

Parents often ask, “How come we weren’t taught all the good stuff about money when we went to school and how come our kids aren’t taught about money at school now?” The fact is, kids are taught about money at school. They are taught what it looks like, how to add it up, and how to work out percentages. Some kids, if they choose the right subjects as they grow older, can have the opportunity to learn how the government wants them to manage their money to meet legal and taxation requirements. The problem is, kids were taught how to count, but they are not taught what counts. What’s missing and what kids would really benefit from being taught is how to MAKE it and VALUE it so they invest and manage it wisely in order to become independently wealthy!

The reality is that the vast majority of teachers are in the profession because they love to teach, help people and are passionate about learning. They certainly don’t do it for the money. Most of them are paid quite poorly when you consider the complexity and responsibility within their role. Teachers who are out to make a difference in children’s lives rarely have an entrepreneurial mindset. Very few are likely to be able to model and teach how to become an entrepreneur and how to make money work for you through investing in assets that generate income. Most of them never learnt it themselves and don’t have it on their radar as being important. They are more likely to teach what they model themselves – study hard, go to college and get a secure, well paid job.

Prior to the Industrial Age, children spent most of their time with their parents. Their parents taught them everything they knew including what was important to them (their values) and work skills. With the onset of the Industrial Age, children started spending more and more time at school and less time with their parents. The school curriculum primarily focused on teaching work skills to help children secure a job. Education about values was rarely in evidence. As consumerism took over and parents decided that both needed to work to buy all of the things they wanted, they spent even less time with their children to discuss values and day to day living skills such as money management.

Parents were now expecting the education system to teach the real life skills. However, the classroom environment at most schools is very different to real life situations. They do not replicate the companies you work for nor deal with money as in the real world. It is virtually impossible for school teachers to make learning about money meaningful for students when at best they can only use play money and simulated situations in the classroom, and most schools don’t even do this.

Ask yourself, “When did I get real about money?” Most people answer that money only really affected them when they didn’t have enough. One of the main pain points many people experience is when they discover that they don’t have enough money to live away from home. This pain point of being cash poor severely limits the independence they crave. Once they experienced a painful enough event in their life, they decided to learn how to make money for themselves and to later work out how to increase the amount they made. For most people, once it became about real money and real purchases and real work and real independence, they really started to learn.

The problem for many is that they only started to learn once they had their mortgage and steady job. Then they remained in an almost trance-like situation of going to work to pay the bills. They forgot to continue to learn more about money in order to keep improving their financial situation. In what seemed like no time at all, the kids grew up, went to college, and left home. The cycle then begins again and now they continue to live in this “box” society has created.

The parents were so busy working and running manic activities schedules for the children, they didn’t even notice they weren’t making the time to learn about how to really get their money working for them. It was all perfect, because raising their children was the most important thing in their lives. They just forgot to step back and realize that by spending some regular and dedicated time on learning about money, they could have saved a great deal of time in the long term and also earned them a great deal more money than just working their day jobs.

Parents didn’t learn to be entrepreneurs when they went to school. It would be highly unlikely that schools can train their teachers to be entrepreneurs today either.

Fast forward to the present, parents trust that their children are learning the value of money and these life skills at school. They are often surprised when they leave school and to not have these financial skills. Young people are finishing school, whether high school or university, with a whole set of skills that are sadly underdeveloped, and these are skills crucial to their success. Students are simply not learning the skills that matter most for the twenty-first century.

As parents, you have the perfect opportunity to help your children learn about money from an early age, preferably early enough that they learn really good habits around wealth creation and not even notice they are learning. Good modeling and habits as part of your family life are amazingly powerful tools for success. Committing some time and effort in the short term will save you and your kids in many ways in the long term and everyone gets to win and have a better life!

Money Jars: The Kid-Proof System for Saving and Spending Money: Part 6

Money Jars: The Kid-Proof System for Saving and Spending Money: Part 6

You made it! We are finally at the close of our 6-Part Money Management System for Kids. Thank You for keeping up with this Series and I hope you’ve enjoyed reading.

Why I Saved The Best Jar For Last

The Money Jar we are about to discuss is extremely important. It will literally set the foundation for your kid’s financial future. This jar is why I got into teaching kids about money in the first place. It is EPIC, monumental, the pillar of your kid’s finances. It is hands down THE MOST Important Jar. This is why I saved it for last…..I wanted to end this series with a bang! 🙂

The True Money Jar

Let’s talk about the Financial Freedom Jar, also known as the FFA. I referred to it as the true money jar because it’s the only jar that is supposed to “Make Money” for your children. When they put money into the FFA, they are to NEVER, and I mean NEVER, touch it, unless they are going to invest the money. And of course that investment should give them a return in interest, thus making them more money.

Let’s talk about the Financial Freedom Jar, also known as the FFA. I referred to it as the true money jar because it’s the only jar that is supposed to “Make Money” for your children. When they put money into the FFA, they are to NEVER, and I mean NEVER, touch it, unless they are going to invest the money. And of course that investment should give them a return in interest, thus making them more money.

The rules are pretty simple with the FFA. Money goes in and only comes out to invest in a vehicle that makes more money. This is so critical to your kid’s financial freedom. The only way they’ll ever achieve financial freedom is to get their money working for them instead of the other way around. The FFA is designed to accomplish this goal.

Temptations

Along the Road to financial freedom there may be several temptations. Please warn your children that they may have the urge to use the money in the FFA for things they want at that moment in time. It’s important to instill in them the concept of delayed gratification. Anything of real value is going to take time and this is no exception. Your kids need to put at least 10% of all their earnings into their Financial Freedom Jar and let it sit until the time comes to make an investment with it.

Oh by the way, this is the jar they allocate to FIRST! One of the fundamental principles of the wealthy is they always pay themselves first. This is the way your kids can adopt this principle, by paying themselves (the FFA Jar) first. Always. Always. Always.

Well that concludes our series. This is the structure to teach your kids money management skills. If you teach this system to them early, they will not only be financially responsible, but they will thrive in this area. You can breathe easy knowing that your child is prepared for the real world.

To You and Your Kids Wealth,

Melanie Jane

Related Articles:

Money Jars: The Kid-Proof System for Saving and Spending Money: Part I

Money Jars: The Kid-Proof System for Saving and Spending Money: Part II

Money Jars: The Kid-Proof System for Saving and Spending Money: Part III

Money Jars: The Kid-Proof System for Saving and Spending Money: Part IV

Money Jars: The Kid-Proof System for Saving and Spending Money: Part V

From the Desk of Melanie Jane Nicolas – January 2013

5 Languages of Love for Kids – My Daughter Jayden

http://youtu.be/yOVn7dXMz_A

Money Jars: The Kid-Proof System for Saving and Spending Money: Part 5

Money Jars: The Kid-Proof System for Saving and Spending Money: Part 5

It’s time to have some fun!!! Today is Part 5 in our money management for kids’ series and the topic of discussion is the Play Jar.

It’s time to have some fun!!! Today is Part 5 in our money management for kids’ series and the topic of discussion is the Play Jar.

As a mom, I often find it difficult to “treat myself.” I’m guilty of always putting everyone else ahead of myself. Even going to the spa for a massage is a big deal for me. I’m constantly working the concept of “Rewarding Myself.”

You Are Worthy

This lesson is just important for parents as it is for kids. You are deserving of having nice things. You are deserving of going to nice places. After you have been so responsible managing your money, you can let loose and pay for things just for pure enjoyment.

The same principle goes for your kids. After carefully allocating their money to pay for living expenses, savings, donating and education, it’s time to relax and enjoy themselves. It may be toys, games, a trip to the movies or the skating rink. Whatever they consider fun and pleasurable, that’s what the money in this jar is used for.

The Fun Rule

There is a fun rule that is associated with the Play Jar. Your child MUST spend ALL of the money in this jar each month. Think of it in terms of rollover minutes. In this case the minutes are dollars and our contract doesn’t allow rollovers.

It’s important for your children to be disciplined with their money. It’s also just as important to relax and HAVE FUN! If you often feel guilt around spending money on yourself to have a good time, it’s especially important that you teach your kids to use the Play Jar. They can learn early that they deserve to treat themselves to nice things.

It’s all about balance. The more serious money matters are just as important as the fun stuff. Using the jar creates a system of checks and balances so that one area is not emphasized any more than the other.

Remember to have your child allocate 10% of his or her earnings to the Play Jar.

Please join the conversation and let me know your thoughts below. Feel free to comment, share, and ask questions.

To You and Your Kids’ Wealth,

Melanie Jane

Related Articles:

Money Jars: The Kid-Proof System for Saving and Spending Money: Part I

Money Jars: The Kid-Proof System for Saving and Spending Money: Part II

Money Jars: The Kid-Proof System for Saving and Spending Money: Part III

Money Jars: The Kid-Proof System for Saving and Spending Money: Part IV

Money Jars: The Kid-Proof System for Saving and Spending Money: Part VI